LLC for E-commerce Formation

Set up your own LLC to skyrocket your e-commerce business, get legal protection, and boost your client credibility. A Limited Liability Company offers the perfect blend of liability protection and tax advantages, whether you’re an e-commerce business owner or a solo entrepreneur.

Run your global e-commerce business from anywhere, enjoy countless financial perks, and leave the admin and compliance worries to us.

How does the e-commerce LLC formation service work?

Establishing your own LLC will give your e-commerce business a professional edge and open many growth opportunities for you.

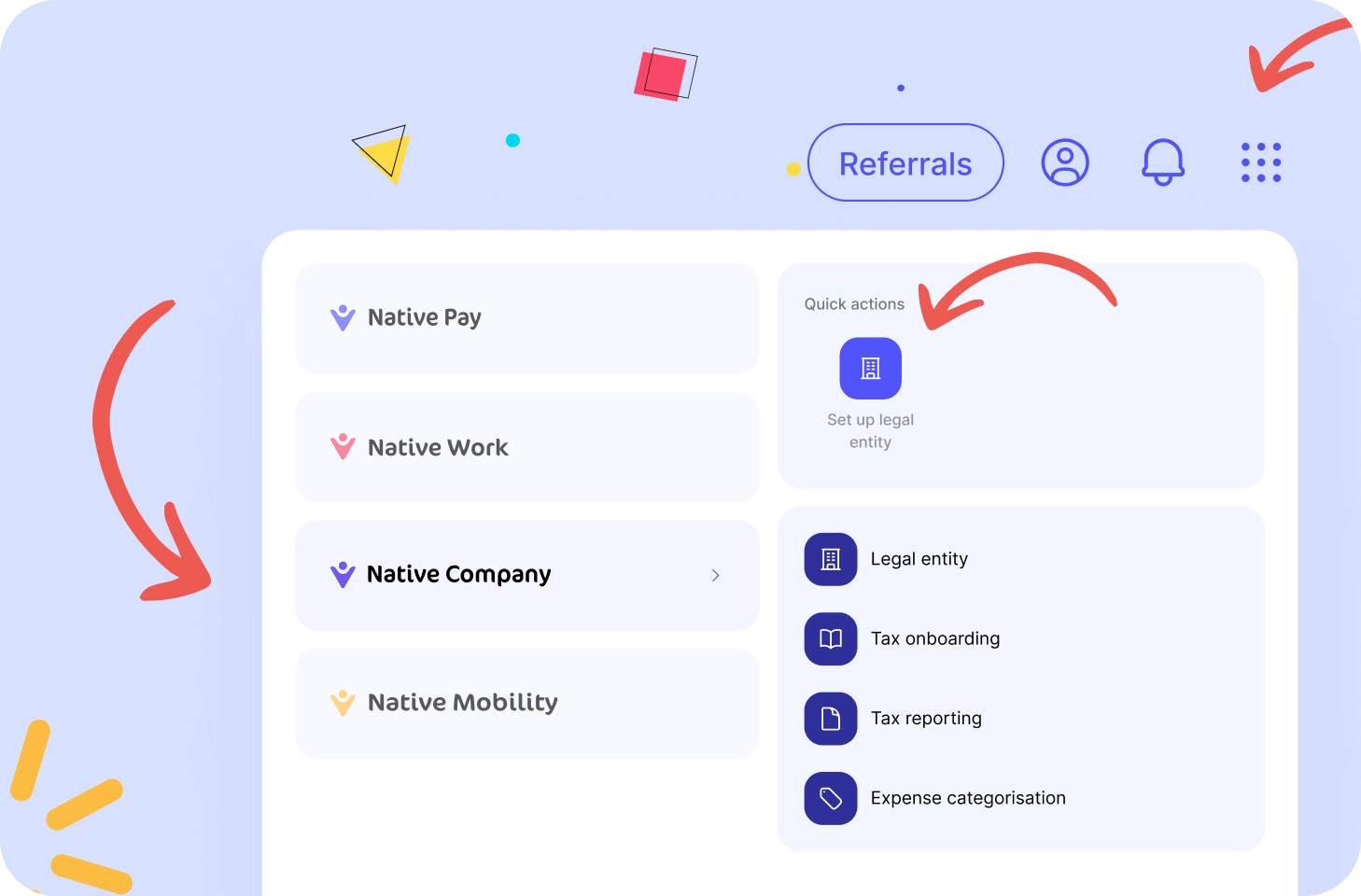

Subscribe to our Native Company plan.

Click on the “Set up legal entity” button in your wallet under the Native Company section.

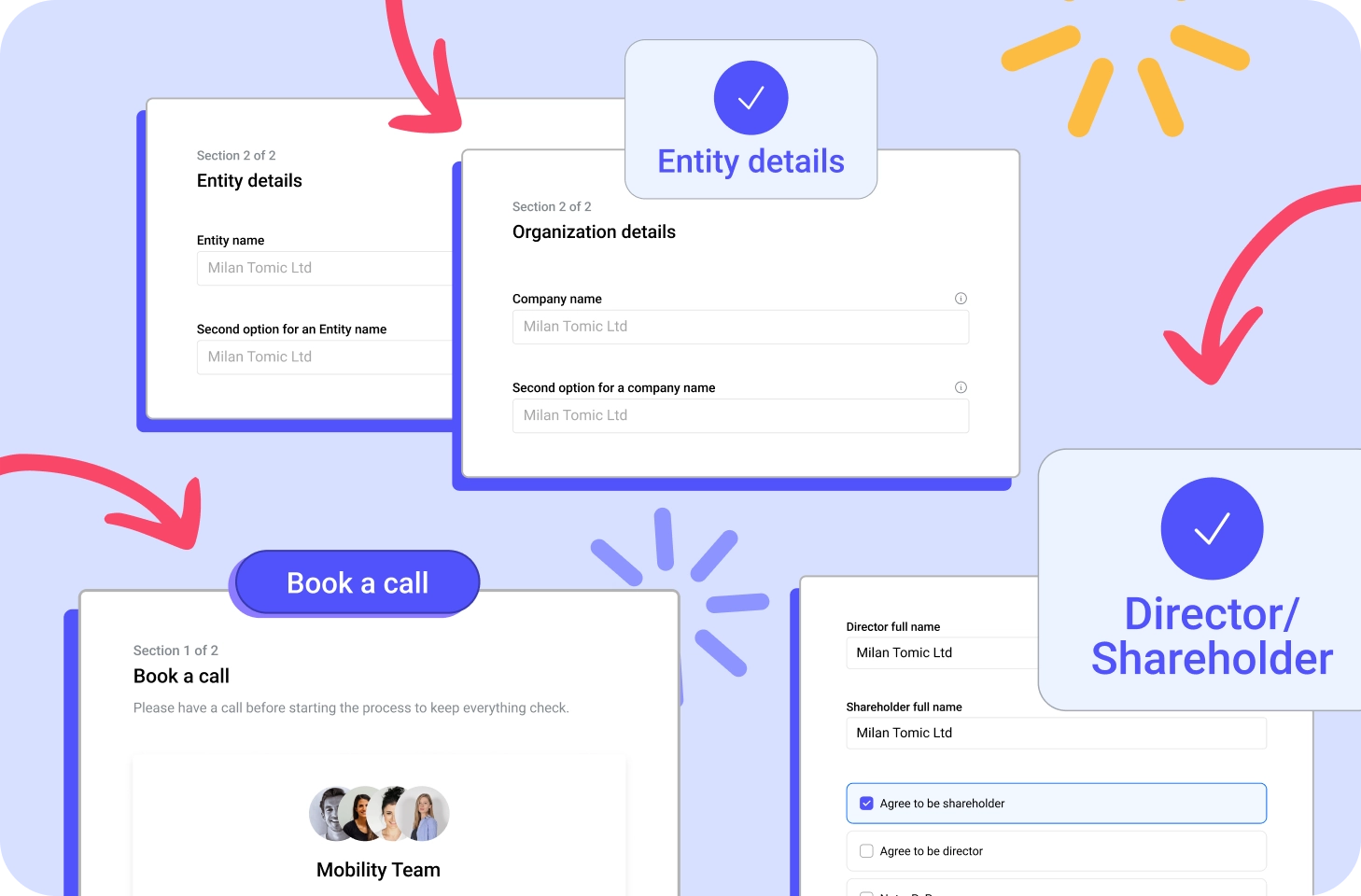

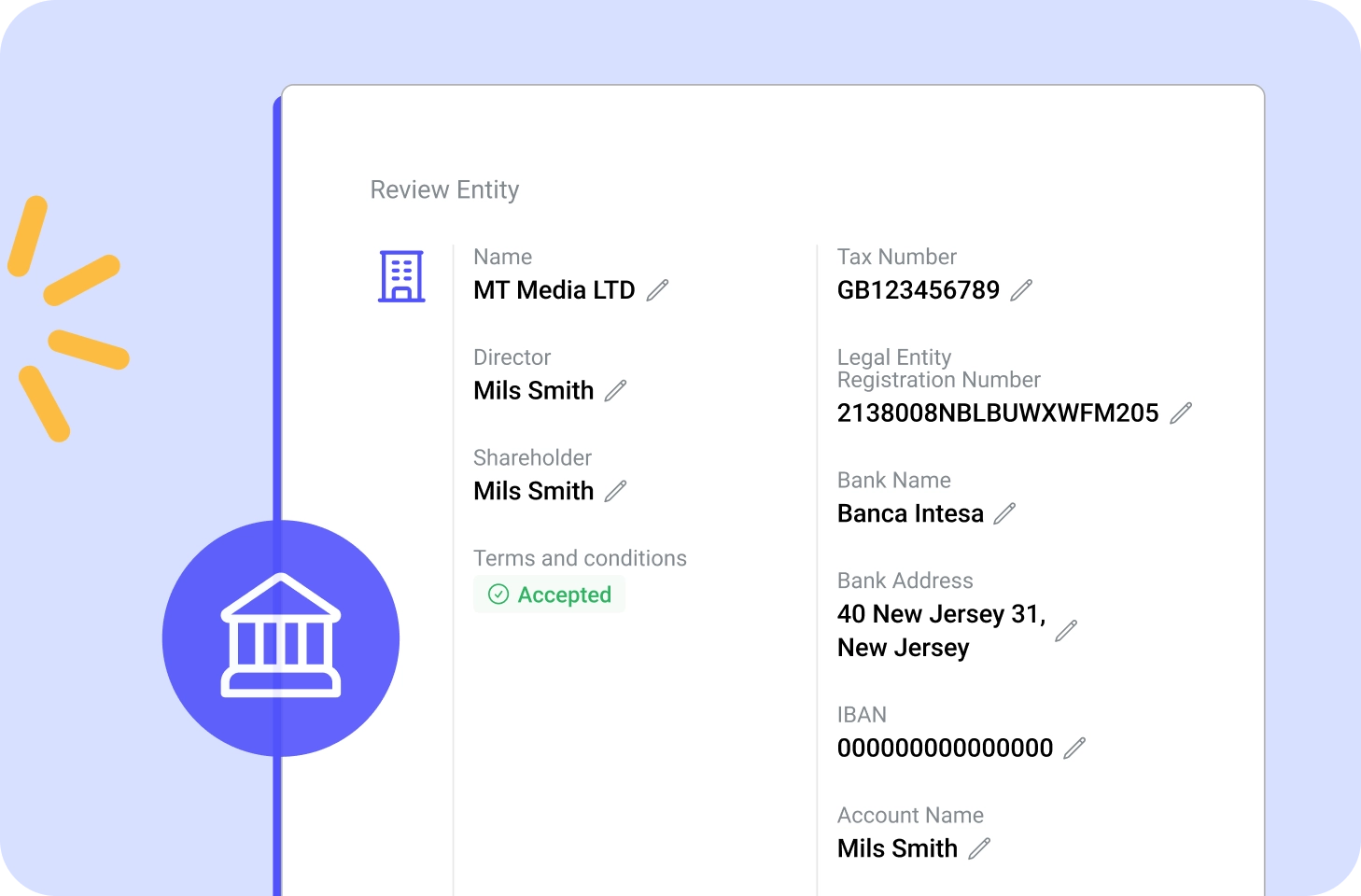

Provide the required information about your LLC, including entry details, directors, and shareholders, or book a consultative call with our team for assistance.

Once you provide the necessary information, our team will reach out to you for the company formation and explanation of the tax reporting process.

After a few days, you will receive an email confirmation from the government, and our team will update your request in the app for easier tracking.

When your e-commerce LLC is set up, we’ll report the annual tax and stay in touch with you for mail handling and tax reporting.

LLC for e-commerce features

Get an all-inclusive e-commerce LLC set up to help you start your entrepreneurial mission.

UK legal entity

Get a fully established UK legal entity to maximise your profit and benefit from a business-friendly environment. Native Teams will handle the establishment process from start to finish, without UK residency requirements or admin and compliance tasks on your end.

Legal entity wallet

Access a convenient business wallet for all your e-commerce needs. Easily manage all of your business funds, process e-commerce payments, and track business expenses - all within a single place, without any hidden fees.

Stripe integration

Easily integrate your e-commerce shop with Stripe to provide a smooth and issue-free experience for your customers, and rest assured that your business payments run efficiently, safely, and transparently.

Diverse payment

processors

Enjoy the flexibility to select from the thousands of available payment processors. Whether you need a more extensive global reach or prefer comprehensive processing features, Native Teams will ensure seamless integration to match your unique e-commerce needs.

Why do you need an LLC for an e-commerce business?

Take advantage of a fully-fledged LLC for your e-commerce business with Native Teams by your side.

Save time and money

We will handle the entire setup process so you can focus on growing your e-commerce business and save valuable time and resources.

Optimise your taxes

Enjoy the various tax advantages of your UK LLC, including potential tax deductions, allowances, and lower income taxes.

Access tax reporting

Get the necessary expertise and support to report taxes compliantly. We will handle annual tax reporting and provide ongoing assistance with all tax matters.

Limit personal liability

Protect your personal assets from any business liabilities to secure your financial future.

Enhance credibility

Obtain a formal LLC structure to provide a legal framework and enhance your professional image among your clients and stakeholders.

No admin and compliance worries

Grow your business with the ultimate peace of mind, knowing that all your paperwork and compliance requirements are handled by experts.

Taxes for LLC e-commerce business

With your own e-commerce LLC, you can embrace countless tax optimisation opportunities and save more of your hard-earned profit.

Low corporate tax rates

As an LLC owner, you’re paying a 19% corporation tax rate on your profit, which is lower than income tax rates for individuals with high earnings.

Deductible business expenses

LLC owners can reduce their taxable profit by claiming tax deductions for business expenses, such as salaries, rents, utilities, and other operational costs.

Lower tax on dividends

When paying out dividends, you can benefit from lower tax rates than salary taxes and, hence, reduce your personal income taxes.

VAT registration benefits

If your LLC’s turnover exceeds the VAT threshold, you must register for VAT, which will later allow you to reclaim VAT on purchases related to your e-commerce business.

*Please note that tax rates and related information are subject to change and may be influenced by current laws and regulations.

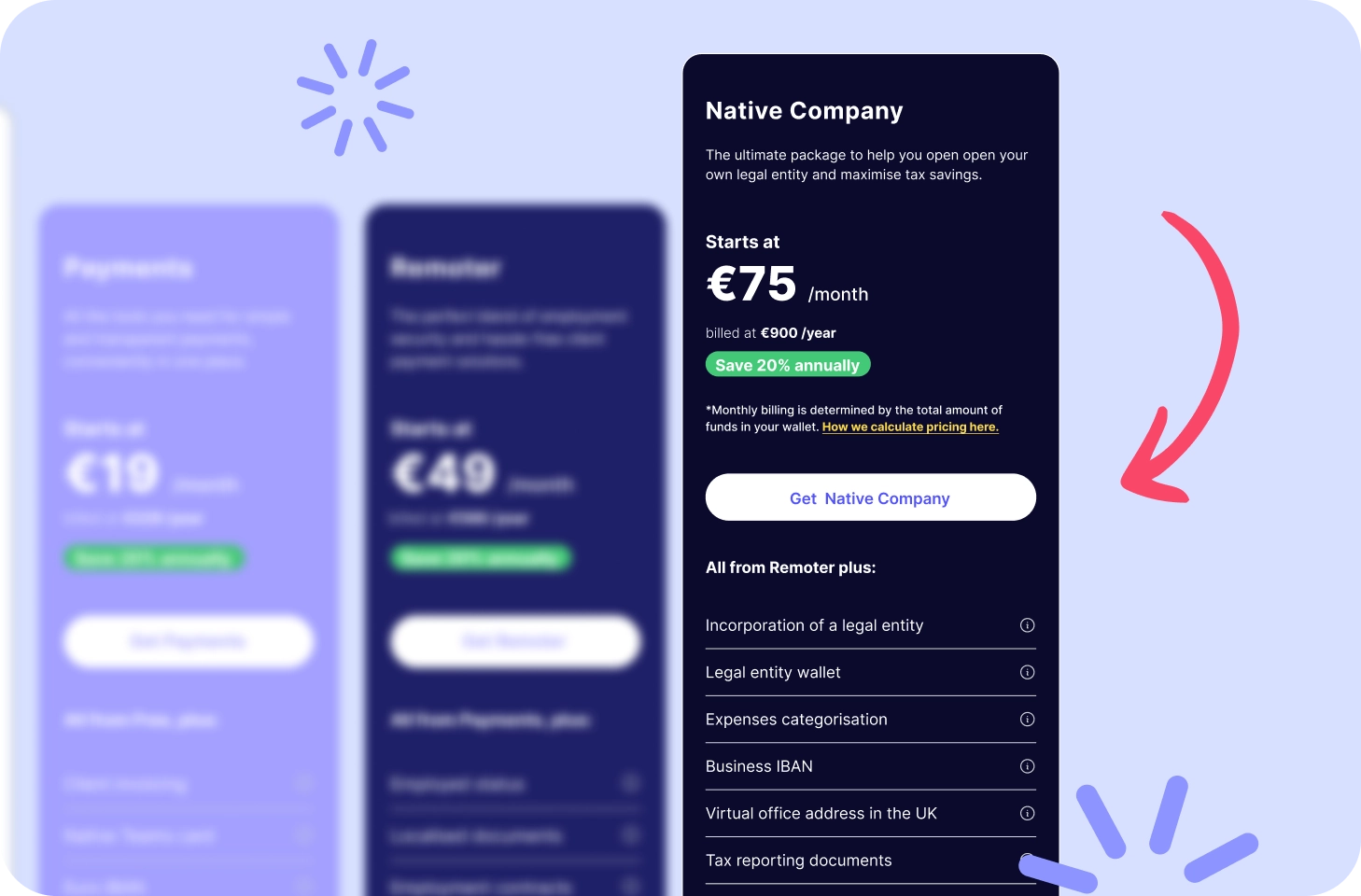

Pricing of Native Teams’ LLC for E-commerce

Set up your e-commerce LLC within only 15 minutes and without any hidden fees for establishing your business and integrating with Stripe. Explore our pricing structure, designed with your transparency, accessibility, and entrepreneurial success in mind.

NATIVE COMPANY

The ultimate package for seamless employment and effortless global team management.

Starts at

€75 /month

billed at €900 /year