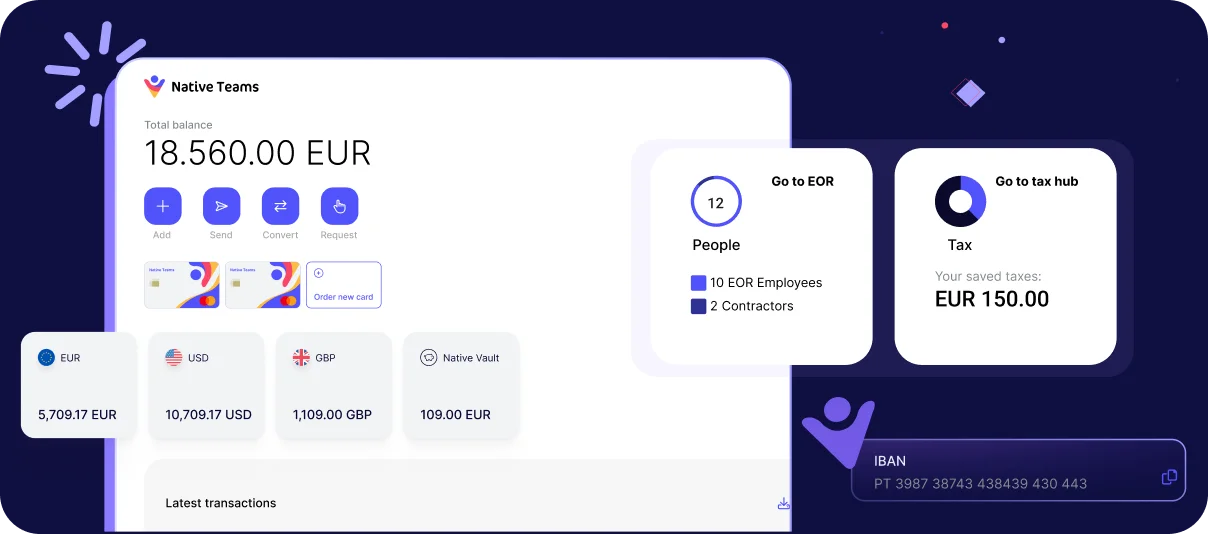

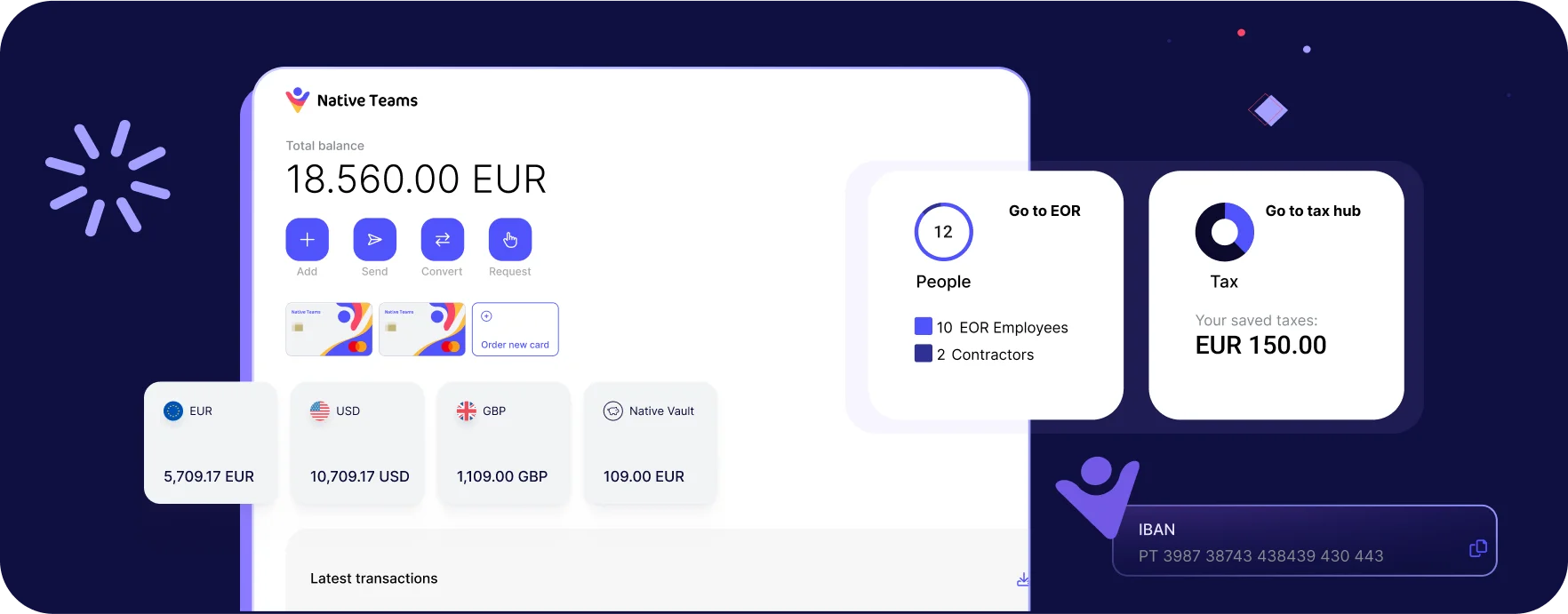

Legal entity wallet

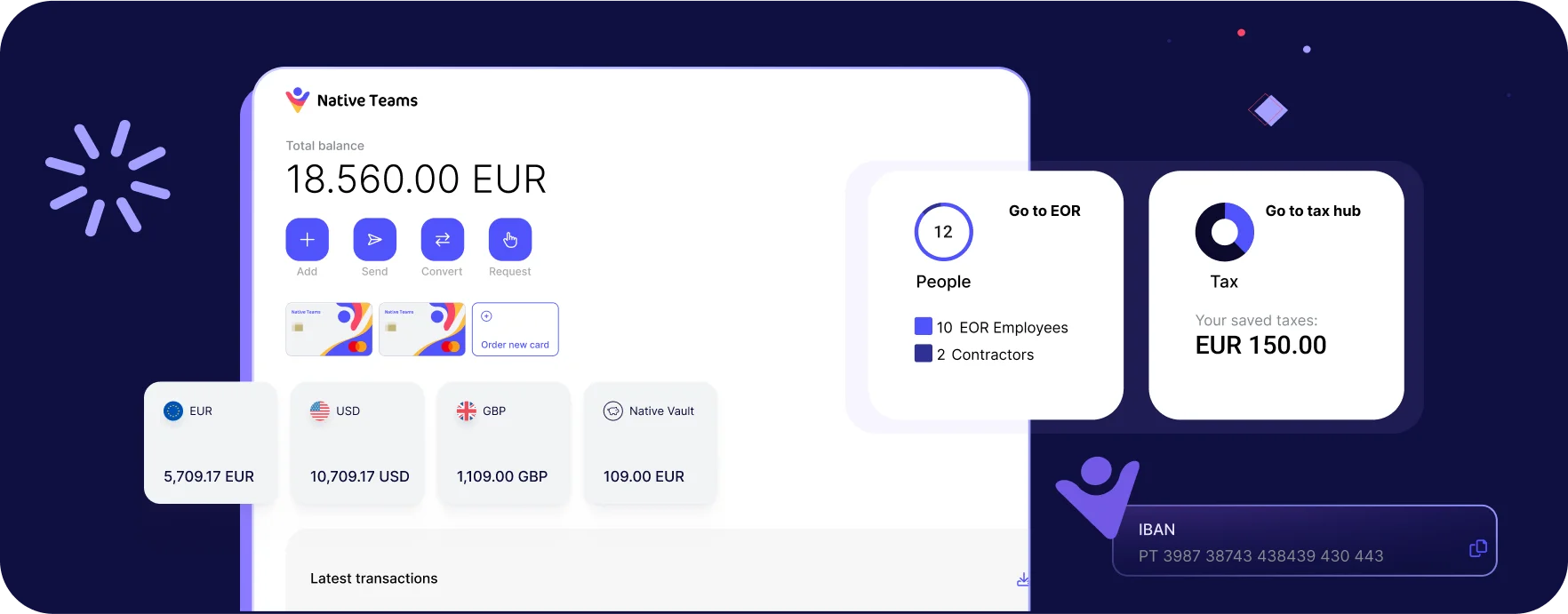

When you establish a legal entity with Native Teams, you get access to a legal entity wallet, which serves as a centralised space for storing and managing your business’s financial assets. Each legal entity wallet comes with a separate UK IBAN to ensure maximum transparency and convenience when making money transfers.

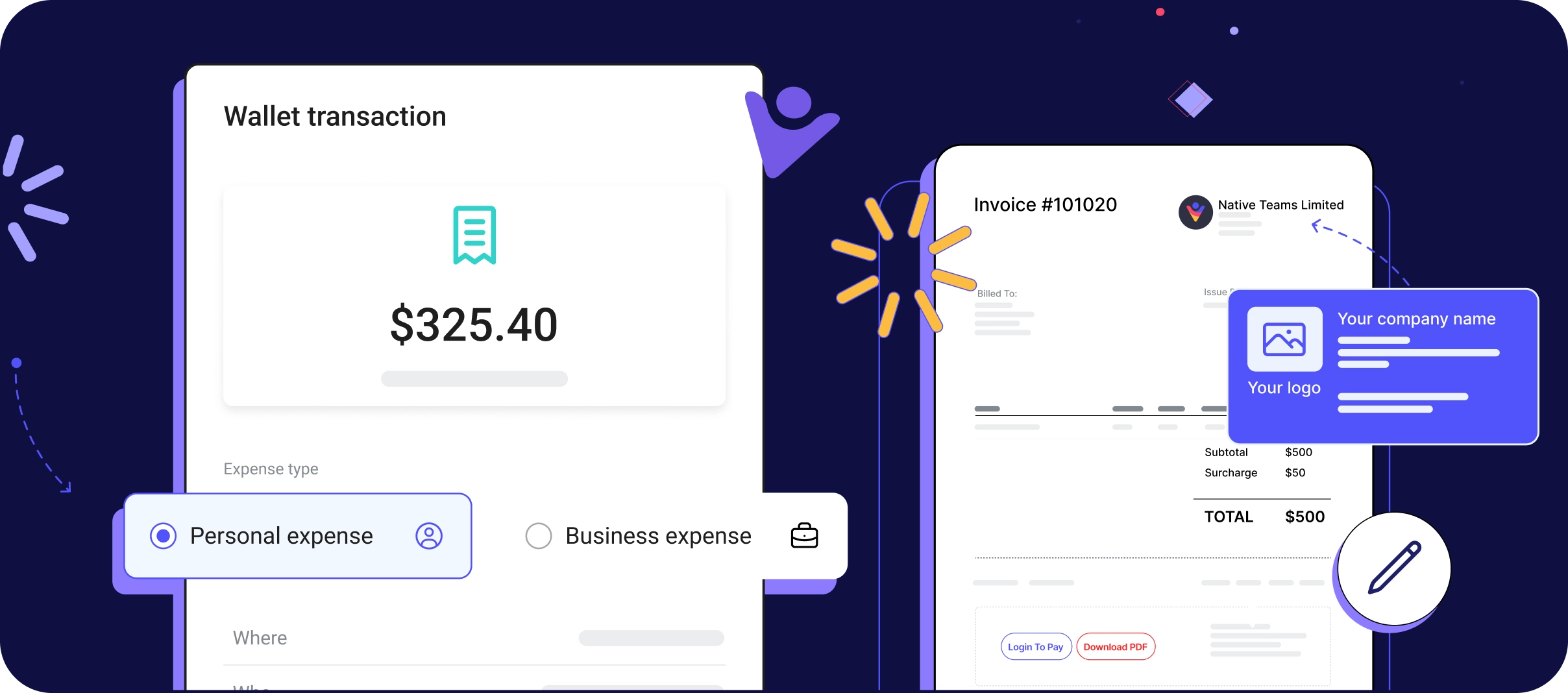

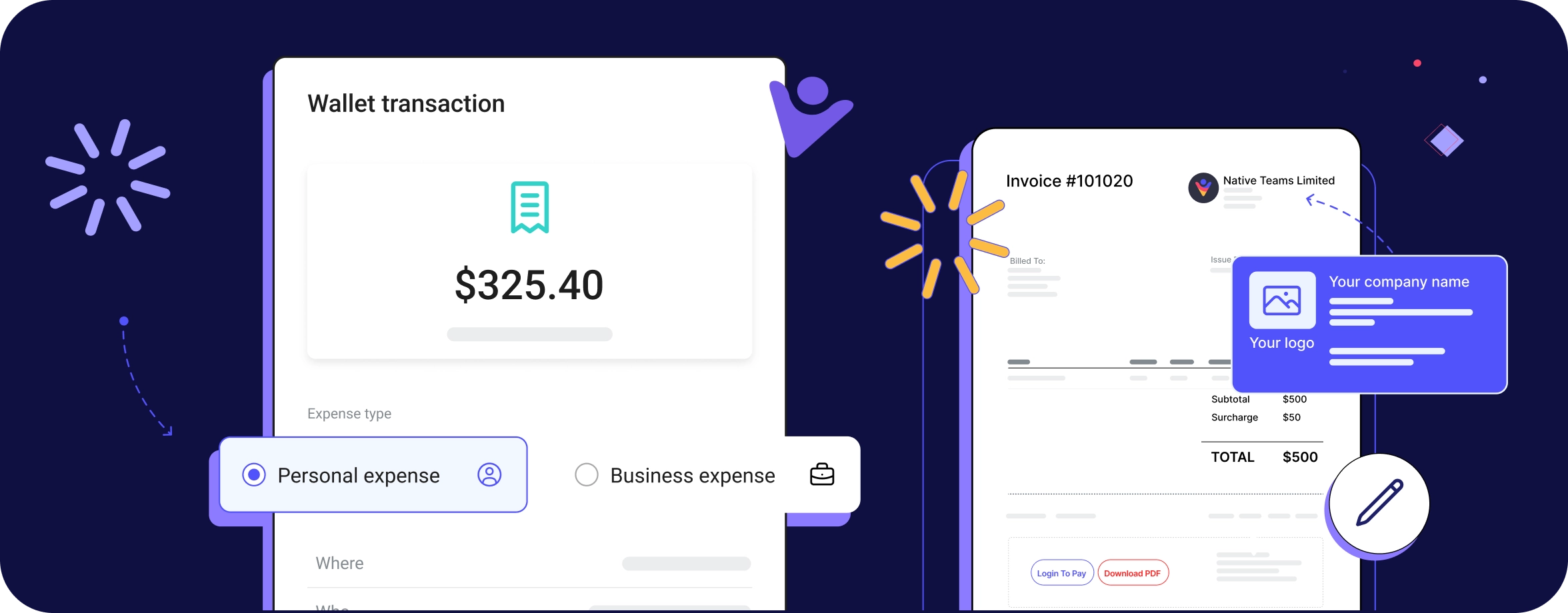

Business bank account

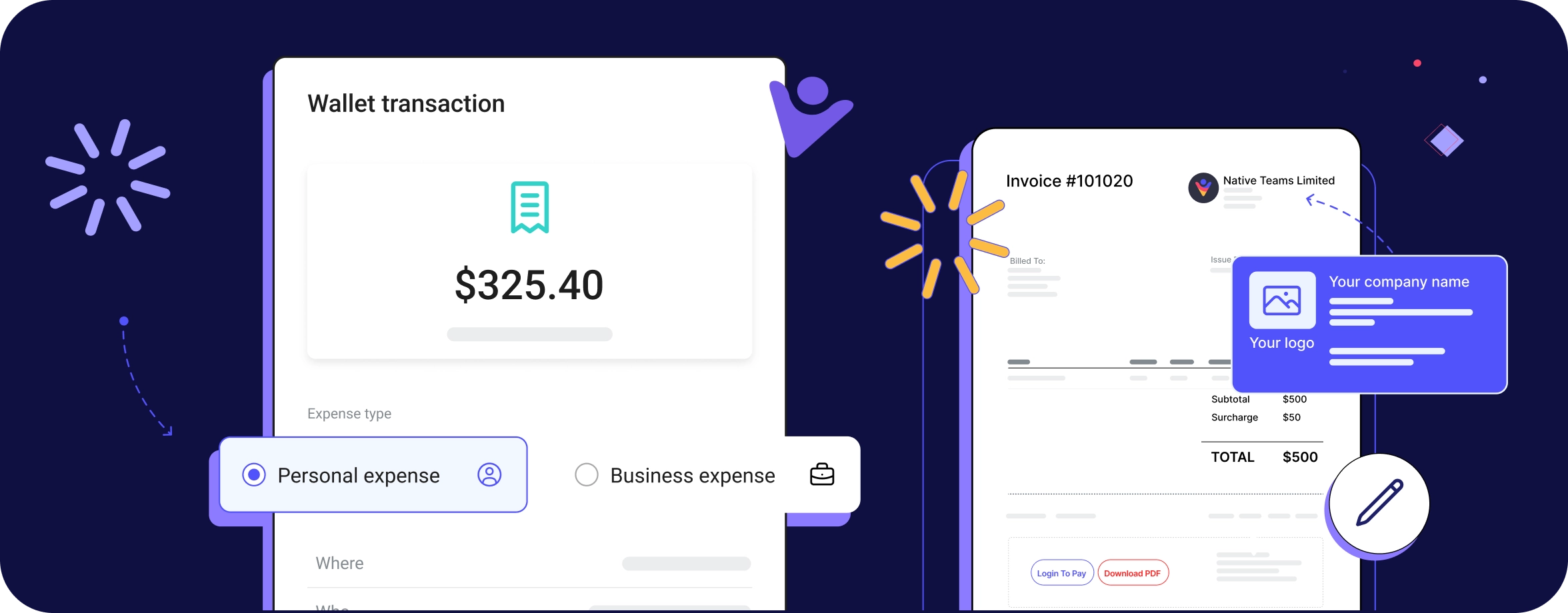

By establishing your UK company with Native Teams, you’re getting a dedicated UK business account that will help you manage your business finances more efficiently. A UK bank account will help you track your income, separate your business and personal expenses, and even create custom invoices to bill your global clients.

Native Teams card

Native Teams will also provide you with a physical or a virtual card that you can easily connect to your Native Teams wallet. You can use your Native Teams card worldwide, whether it’s for online or in-store transactions.

UK IBAN

Your UK bank account comes with a designated UK IBAN, allowing you to make simple and transparent transactions worldwide.

With a dedicated UK IBAN, you can send and receive international payments directly to your Native Teams account without significant delays. Apart from safe and transparent global transactions, a UK IBAN will minimise currency conversions and fees, providing maximum security and convenience for making worldwide transactions with ease.

Dependency test

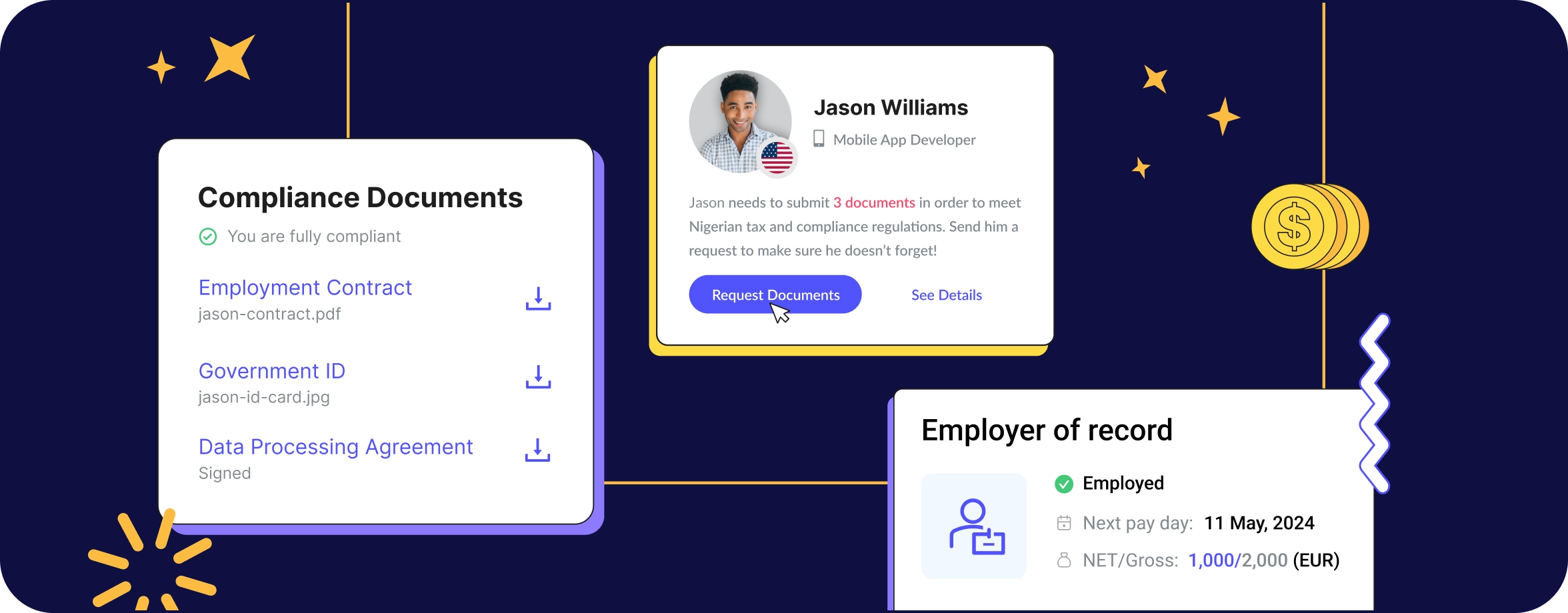

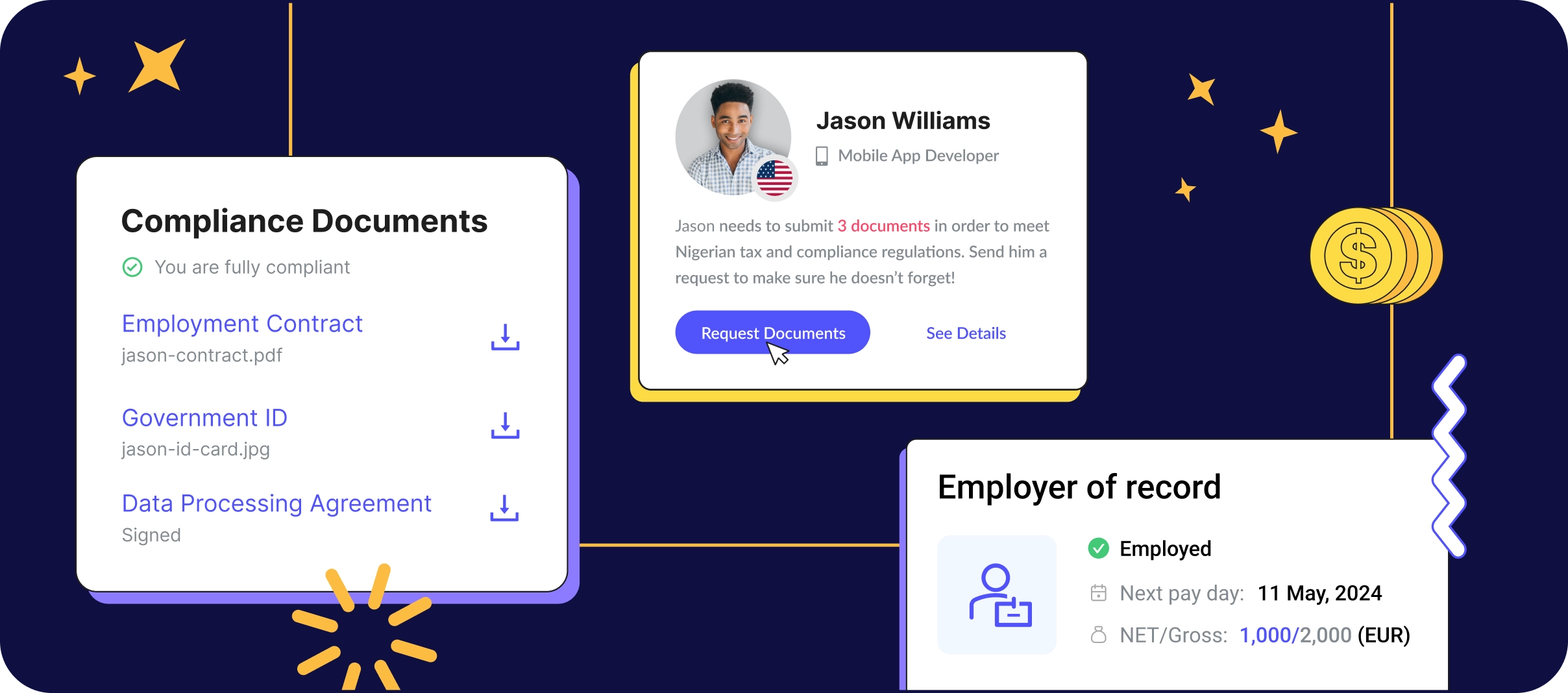

With Native Teams, you can skip all the standard tests to determine whether you’re considered an employee or a self-employed individual. Our professional teams will provide you with a streamlined dependency test process so you can ensure that you’re compliant with all the applicable tax and legal requirements.

Tax reporting

With Native Teams, you can ensure that you’re staying compliant with all the tax reporting requirements. Our tax teams will guide you through calculating your tax liabilities, organising financial data such as income, expenses, and deductions, and providing the required transparency when filing taxes with the UK tax authorities.

Expert assistance

With Native Teams, you can ensure that you’re getting expert assistance from our tax and legal teams through every step of setting up and managing your UK company.